In general, market always goes up because people are working hard and business and industry support a lot of innovations to compete each others locally or globally. Nobody wants market to go down that is why our world is developing so much compared to the last century.

However, market frequently goes down due to

1. Mismanagement in politics.

2. Mismanagement in financial institution including banks, federal reserve, and credit rating agencies.

3. Mismanagement in business likes Lehman brothers.

4. Fraud in business likes Bear stearns.

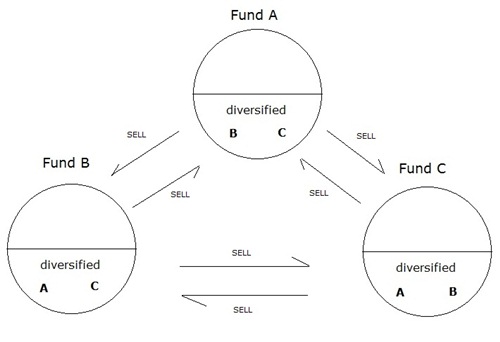

5. Systematic manipulation by the greedy company such as greedy hedge fund.

6. Lack of required regulations.

7. Excessive regulations.

Dodd–Frank Wall Street Reform and Consumer Protection Act stabilizes the market initially. However, business can’t growth in America because of that law. In fact business have to move elsewhere that generate more unemployment. For example, Apple have many great innovation recently however they manufacture the innovative product in Japan, the Philippines and China. Excessive regulations has made it too expensive to manufacture anything domestically.

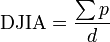

8. More liberal agencies on excessive spending.

9. Unnecessary war like Libya.

Cost of Libya Intervention $600 Million for First Week, Pentagon Says

10. Excessive spending for majority of people to get votes

In fact, the combination of trigger needs to have sell off.

1. Combination of negative news such as Europe credit problems, US debt problems, S&P credit downgrade news.

Coming up: more bad news on Student loan debt grows, Consumer Credit Card Debt grows and so on.

2. Most of the TV station needs high rating in order to survive in the market. In fact, they like more bad news because bad news get more attention for viewers. That is also true for periodicals and comedians. In fact, they try to fire more bad news and bad news comment as well as bad speculations. Actually, they are no more than greedy businesses.

In this August selloff, US Public Pension Funds Lose Billions. According to the Huffingtonpost

- California’s main public-employee pension fund, the nation’s largest, has lost at least $18 billion off

- Florida’s pension fund has lost about $9 billion since June 30

- Kentucky, which has more than $20 billion in unfunded pension liabilities

Actually, those losses are penny compared to the Rich lost.

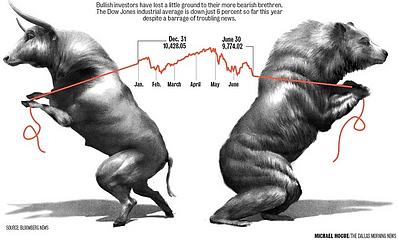

That is known as FEAR not normal market correction however this processes will be happened again and again. Selloff is de-risking from the market due to uncertainty. However, after Selloff, investors face another risk called currency risk because US dollar is fallen apart. In fact, most of the assets transform to Gold and US treasury which was just downgraded to AA+.